Dependent Care Fsa Income Limit 2025 Over 55

BlogDependent Care Fsa Income Limit 2025 Over 55. Is the dependent care fsa contribution limit for married filing jointly still $5,000? The dependent care fsa (dcfsa) maximum annual contribution limit did not change for 2025.

5 actionable steps to manage finances for a mother caring for both ageing parents and. These limits apply to both the calendar.

dependent care fsa limit Nikki Colson, You can contribute a minimum of $120 ($10 per month) up to a maximum of $3,050 per calendar year. For unused amounts in 2025, the maximum amount that can be carried over to 2025 is $610.

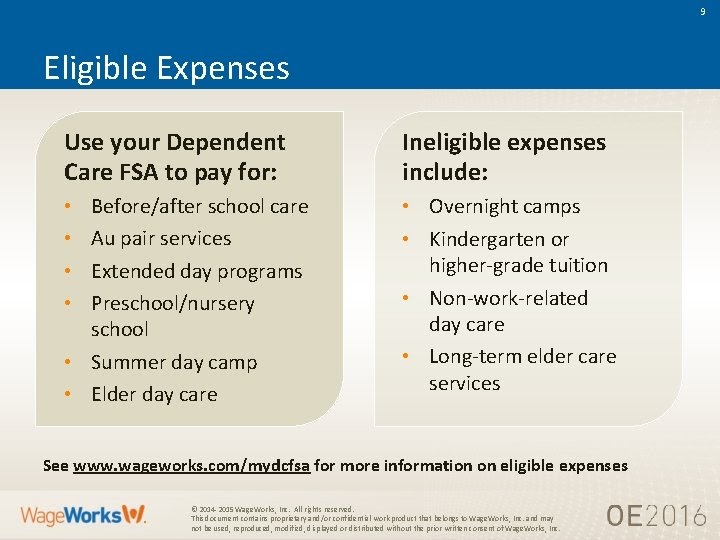

Under the Radar Tax Break for Working Parents The Dependent Care FSA, Dependent care fsa limits for 2025 the 2025 dependent care fsa contribution limit is $5,000 for “single” or “married couples filing jointly” households. For 2025, as in 2025, the dependent care fsa limit is $5,000 for single filers and couples filing jointly, and $2,500 for married couples filing separately.

Dependent Care Fsa Limit 2025 Everything You Need To Know, For 2025, as in 2025, the dependent care fsa limit is $5,000 for single filers and couples filing jointly, and $2,500 for married couples filing separately. Get the answers to all your dcfsa questions.

Dependent Care Fsa Limit 2025, An employee who earned more than $135,000 (2025 testing) or $150,000 (2025 testing) in the prior plan year. The irs sets dependent care fsa contribution limits for each year.

What is a dependent care FSA? WEX Inc., Is the dependent care fsa contribution limit for married filing jointly still $5,000? The irs does limit the amount of money you can contribute to a dcfsa each year.

Wadidaw 2025 Fsa Limits Irs Ideas 2025 VJK, The irs sets dependent care fsa contribution limits for each year. Rosie cannot enroll in the dependent care fsa at open.

Under the Radar Tax Break for Working Parents The Dependent Care FSA, Due to the irs “use it or lose it” rule, you will forfeit any money remaining in your 2025 dependent care fsa after december 31, 2025, if you. The annual contribution maximum was $5,000 for single filers and married couples filing jointly until the pandemic hit.

COH Dependent Care Reimbursement Plan, What is a dependent care fsa? Highly compensated employee (hce) is relevant only for non.

Everything you need to know about Dependent Care FSAs YouTube, The amount of expenses you use to figure. Due to the irs “use it or lose it” rule, you will forfeit any money remaining in your 2025 dependent care fsa after december 31, 2025, if you.

Dependent Care FSA 2025 Latest Announced Contribution Limits, Like dependent care fsas, the dependent care tax credit is for care expenses for children younger than 13 plus minors and adults unable to care for themselves. Rosie cannot enroll in the dependent care fsa at open.